HONG KONG, Jun 27, 2022 – (ACN Newswire via SEAPRWire.com) – The first industry forum (“the Forum”) under the “SME ESG Best Practices Recognition Programme” (“the Programme”) took place today under the joint auspices of Dah Sing Bank, Limited (“Dah Sing Bank”) and Friends of the Earth (HK) (“FoE HK”). Held in the theme of “ESG Practices in Property Development Supply Chain – Opportunities and Challenges for SMEs”, the Forum featured listed company senior executives and leaders in the property and construction sector to share their insights on the impact environmental, social and governance (ESG) trends have on the outlook and operating models related to their industries.

|

|

|

|

|

|

|

Addressing the Forum, Mrs Mei Ng, BBS, Chairperson of FoE HK, said, “SMEs are closely intertwined in every aspect of our daily lives. Notwithstanding their contribution to our society, economy and livelihoods, they also impact on our ecological environment, social development and daily production in a big way. FoE HK believes there is a critical and urgent need to help local SMEs transform, upgrade, strengthen and enhance their competitiveness as well as their ESG accountability. ESG can help SMEs come to grips with matters concerning their survival, risks, transformation, potential and opportunities, helping them to achieve profitability without polluting the world, run their business worry-free while winning word of mouth, customers and investors, and a bright future.”

ESG implementation may become one of the ways for SMEs to overcome adversity in a down market. The convergence of external economic pressures and the pandemic is presenting unprecedented challenges for SMEs. With the rise of a green economy, corporations are becoming more demanding in their partnership and supply chain governance standards and requirements. For listed companies, ESG implementation is not just to meet regulatory requirements, but also to help enhance the sustainability of their supply chains. As such, SMEs stand to gain from reviewing their existing operating models for alignment with global sustainable development strategies. The integration of an ESG mindset into their business operations and decisions will enable their products, services and brand image to stand out, thereby helping them enhance their competitiveness and resilience.

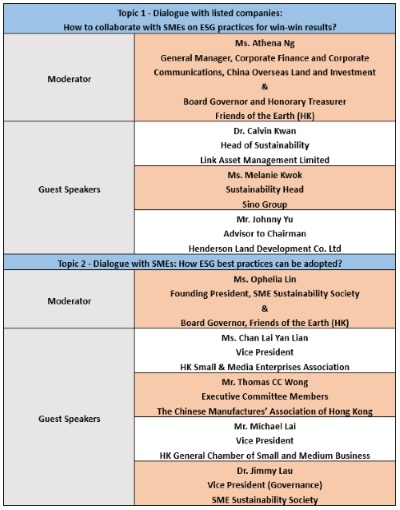

Through the sharing of insights from industry leaders, the two-part Forum seeks to help SMEs understand the latest ESG trends and the opportunities that may arise through ESG implementation, thereby encourage them to develop sustainable business strategies. Moderated by Ms. Athena Ng, General Manager, Corporate Finance and Corporate Communications of China Overseas Land and Investment & Board Governor and Honorary Treasurer of Friends of the Earth (HK), the first part of the Forum focused on the relevance of ESG to the real estate development supply chain and how to seek win-win with SMEs through collaboration in ESG implementation. The second part of the Forum explored the directions and approaches of ESG implementation; moderated by Ms. Ophelia Lin, Founding President of SME Sustainability Society & Board Governor of Friends of the Earth (HK), the guest speakers suggested ways for SMEs to embark on their ESG journey to enhance the competitiveness of their businesses.

The team of professionals behind the Programme can be described as “ESG doctors” for enterprise development. Consultancies offering such services are a commonplace practice in the market and typically command fees of more than HKD100,000. SMEs taking part in the Programme will have free access to similar support, so that they may be able to identify areas for improvement in their businesses as early as possible and to plan ahead.

Ms. Phoebe Wong, Deputy Chief Executive, Senior Executive Director, Group Head of Personal Banking of Dah Sing Bank, said, “SMEs typically lack ESG-related knowledge and resources. Dah Sing Bank is sponsoring FoE HK to launch this Programme so that more SMEs will become aware of the most pressing ESG issues that concern them, and enable them to identify improvement areas through the Programme’s free assessment and ESG guidelines. Last year, the Hong Kong Government announced its target to achieve carbon neutrality by 2050. As buildings are the main source of carbon emissions in the city, it is pertinent to feature the property and construction sector in the first forum under the Programme. This will create awareness of the urgency for the sector’s SMEs to transition to a low-carbon operating model, and will bring new ideas and opportunities to inspire them to embark on adopting sustainable business practices.”

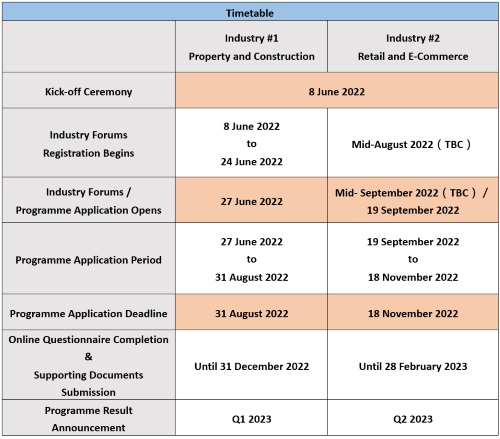

The Programme is the first of its kind that takes on an industry-specific approach to lobby and recognise ESG best practices adoption by SMEs and to promote sustainable development in industries. Using the United Nations Sustainable Development Goals as framework, it evaluates the sustainable development strategies and policies of SMEs and their ability to manage and drive sustainable development performance. SMEs that attain a certain level of improvement within a specific period will be commended for their commitment and contribution. The free-to-join Programme is sponsored by Dah Sing Bank. Additionally, Dah Sing Bank is offering further incentives to all the SMEs participating in the Programme and / or receiving recognition in the form of fee discounts and cash rebates, while recognised participants will also receive an exclusive HKD1,000 cash reward. SMEs in the property and construction industries can enroll in the Programme starting today (27 June) until 31 August 2022. Please refer to the attached fact sheet for details.

This year marks the 75th anniversary of Dah Sing Bank. A series of celebratory activities will be launched from June onwards to reach out to the community, SMEs and customers as well as to promote green lifestyles. Through these activities, the Bank hopes to thank and share its joy with the public and its customers, express its advocacy for sustainable lifestyles, and bring vitality to Hong Kong’s communities and economy. For details, please visit the Bank’s 75th anniversary webpage on http://www.dahsing.com/75Anniv/en.

About Dah Sing Bank

Dah Sing Bank, Limited (“Dah Sing Bank”) is a wholly-owned subsidiary of Dah Sing Banking Group Limited (HKG:2356) which is listed on the Hong Kong Stock Exchange. Founded in Hong Kong 75 years ago, Dah Sing Bank has been providing quality banking products and services to our customers with a vision to be “The Local Bank with a Personal Touch”. Over the years, Dah Sing Bank has been rigorous in delivering on our brand promise to grow with our customers in Hong Kong, the Greater Bay Area and beyond – “Together We Progress and Prosper”. Building on our experience and solid foundation in the industry, Dah Sing Bank’s scope of professional services now spans retail banking, private banking, business and commercial banking. Meanwhile, Dah Sing Bank is also making significant investments in our digital banking capabilities to stay abreast with smart banking developments in Hong Kong and to support financial inclusion at large.

In addition to its Hong Kong banking operations, Dah Sing Bank also has wholly-owned subsidiaries including Dah Sing Bank (China) Limited, Banco Comercial de Macau, S.A., and OK Finance Limited. It is also a strategic shareholder of Bank of Chongqing with a shareholding of about 13%. Dah Sing Bank and its subsidiaries now have around 70 operating locations in Hong Kong, Macau and Mainland China.

About Friends of the Earth (HK)

Friends of the Earth (HK), as a leading environmental advocate, focuses on protecting our local and regional environment, offers equitable solutions to help create environmentally sustainable public policies, business practices and community lifestyles and engages government, business and community to act responsibly. Friends of the Earth (HK) is dedicated to promote green finance and cultivate ESG talents to transition HK and Asia Pacific region into a carbon neutral economy. Friends of the Earth (HK) closely partners with SME associations in Hong Kong (with coverage >3,000 companies), as well as international associations (e.g., World Benchmarking Alliance), with strong access to ESG & green finance talents professionals in Hong Kong, through our CESGA alumni network.

Friends of the Earth (HK) launched the first Green Finance Roadmap of its kind in the APAC region in 2019. One of our key focus would be on building capacity for industry practitioners and general public towards green finance, and hence our events are centered around “Green Finance Connect Education Series”. Examples include Sustainability Leadership Seminars, our Green Finance Symposium on ESG integration. We aim to work with all sectors of the community to build a sustainable society and environment.

Media Enquiries

Dah Sing Bank, Limited

Gigi Lee +852 2507 8629 gigiwclee@dahsing.com

Friends of the Earth (HK)

Tiffany Yip +852 3184 1510 tiffanyyip@foe.org.hk

Strategic Financial Relations Limited

Margaret Lam +852 2114 4956 margaret.lam@sprg.com.hk

Pinky Hui +852 2114 2897 pinky.hui@sprg.com.hk

Cynthia Ng +852 2114 4952 cynthia.ng@sprg.com.hk

Programme website

https://bit.ly/3HJDgPj

Dah Sing Bank offers exclusive Programme Incentives

https://bit.ly/3OncS0l

Copyright 2022 ACN Newswire. All rights reserved. (via SEAPRWire)